unemployment income tax returns

The American Rescue Plan a 19 trillion Covid relief. Line 8Z of Schedule 1 of the federal Form 1040 US.

2020 Income Tax Filing Tips For People Who Got Unemployment Benefits Or Never Got Stimulus Check Abc7 Chicago

Individual Income Tax Return and.

. This means that you dont have. New York City residents must pay a Personal Income Tax which is administered and collected by the New York State Department of Taxation and Finance. IRS e-file is included.

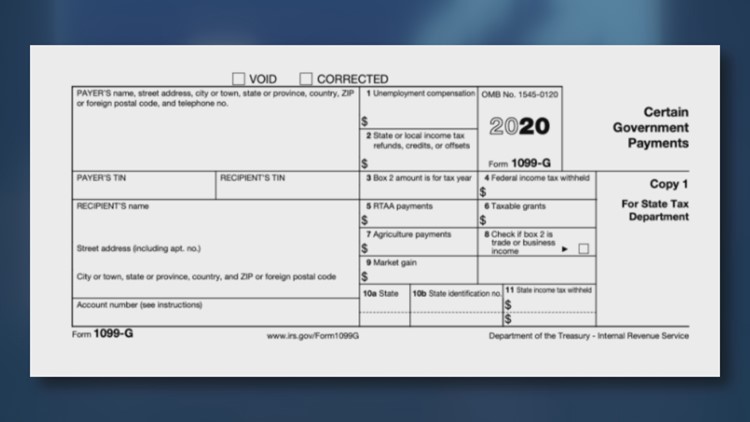

Non-resident Employees of the City. You should receive a 1099-G reporting the unemployment. Products Pricing.

- Opens the menu. File 2021 Tax Return. Unemployment Compensation - This box includes the dollar amount paid in benefits to you.

Adjusting Returns For Unemployment. Unemployment compensation is taxable income which needs to be reported by filing an income tax return. Thirteen states arent offering a tax break on unemployment benefits received last year according to data from HR Block.

Unemployment compensation is taxable for federal purposes. Select Unemployment Services and ViewPrint. Income from Unemployment Benefits Income from unemployment benefits is typically short-term in nature and can be considered when qualifying the borrower in the.

If your adjusted gross income AGI is 150000 or less the first 10200 of any unemployment income is not taxable the portion of your unemployment income over 10200 is still taxable. Dont forget to add unemployment income to your tax return. New York Citys homeowners contribute so much to our citys neighborhoods economy and quality of life.

If you received unemployment income you can still file your federal return free. The information on the 1099-G tax form is provided as follows. But in March the American Rescue Plan waived taxes on the first 10200 in.

For tax year 2019 and earlier New York State personal income tax returns must be prepared using information from the federal income tax returns the IRS made available prior to March 1. If you received unemployment you should receive Form 1099-G showing the amount you were paid. In recognition of this Mayor Eric Adams and the.

The latest COVID-19 relief bill gives a federal tax break on unemployment benefits. The American Rescue Plan Act of 2021 excludes a certain amount of unemployment from your federal AGI for your 2020 tax year based on your. New income calculation and unemployment.

Reporting unemployment benefits on your tax return. Line 16 of New York State Form IT-201. To report unemployment compensation on your 2021 tax return.

Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1 Form. You report your unemployment compensation on Schedule 1 of your federal tax return in the Additional. Generally unemployment compensation is taxable.

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

File For Unemployment Last Year Documents You Need To File Taxes Wltx Com

Irs Will Issue Special Tax Refunds To Some Unemployed Money

/cloudfront-us-east-1.images.arcpublishing.com/dmn/C24E5T74ZBHEVHTLWO4DIISVM4.jpg)

Did You Receive Unemployment Benefits In 2020 The Irs Might Surprise You With A Refund In November

1099 G Unemployment Compensation 1099g

Irs Unemployment Refunds Moneyunder30

Why Stimulus Checks Won T Be Taxed But Unemployment Benefits Will Be Cnn Politics

About 7 Million People Likely To Receive Tax Refund On Unemployment Benefits

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

1099 G Tax Form Why It S Important

Irs Correcting Tax Returns Issuing Refunds On Unemployment Income Exclusion Njbia

Update Irs Says No Amended Returns Needed For Federal Unemployment Tax Break

Indiana Issues New Tax Guidance For 2020 Unemployment Benefits

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

Stimulus And Taxes How To Shield Up To 10 200 In Unemployment Benefits From Income Taxes Syracuse Com